Rsu stock tax calculator

Note that tax rates can change between the time you do this exercise and the time you actually file your return. Net Salaryor Take Home Salary CTCCost to Company EPFEmployee Provident Fund Retirals Deductions Income Tax TDS.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Frequently RSU awards are paid out in equal increments over 3-5 years.

. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. Stock grants often carry restrictions as well. Sales price price at vesting x of shares Capital gain or loss.

Download the desktop version of the app and find the following line under the Personal tab. The of shares vesting x price of shares Income taxed in the current year. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts.

Includes foreign domestic income and resulting tax liabilities. Reporting them on your taxes is important so read on to learn more. Turbo Tax Premier and Turbo Tax Home Business 2020 have added native support for the exercise of ISOs.

Restricted Stock Units RSUs typically become payable to the employee vest over a period of time with the total award divided into increments that vest according to a schedule. Annual stock awards each August Microsoft employees are also eligible to receive new stock awards. Business Income Head covers Equity Intraday transactions Futures and Options.

In a previous post Restricted Stock Units RSU Tax Withholding Choices I wrote about what I chose among the three tax withholding choices same day sale sell to cover and cash transfer and why. If you started early in the year you could receive your first. As the name implies RSUs have rules as to when they can be sold.

Discounted Cash Flow Value. What You Can Expect - 943 Get a sense of what you should and should not expect in the terms of your stock option grant. The interview is a companion to Mr.

Stock bonuses profit sharing sales commissions and tips. This is a taxable event with implications that can affect withholding from your paychecks and your tax liability when you file your tax return. Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash.

You will only need to pay the greater of either your Federal Income Tax or your AMT Tax Owed so try to be as detailed and accurate as possible. Due to the volatility of stock prices lenders typically use a 52-week average stock price to calculate your income from the RSU. The restricted stock units are issued to an employee through a vesting plan and distribution schedule.

Our model gets smarter over time as more people share salaries on Glassdoor. The terms are agreed upon between the employer and employee. In this interview compensation expert Richard Friedman Ayco Company discusses trends in vesting schedules post-termination exercise rules and other plan features.

SP 500 Price to Peak Earnings Ratio. Heres an example of how RSU income might be calculated for a. SP 500 Peak Earnings Yield.

This time Im writing about how to account for taxes on the tax return especially if you use tax software like TurboTax or HR Block At Home. Valuation Theory and Basic Finance Calculators. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount.

An accounting intern of a manufacturing business wants to record the accounting of plant machinery with the depreciation that was calculated as 10000 for the last five years. RSUs that appear on Form W-2 indicate that shares have been delivered to you which usually happens after vesting. Using the ESPP Tax and Return Calculator.

Amazon RSU Tax Withholding When you receive RSUs they are treated as income no matter what. Eddy Engineer has 1000 shares that vest in April of 2022. They stated max salary.

300 Brickstone Square Suite 201 Andover MA 01810 Tel. For high-earning individuals 22 might not be enough and you might find yourself with a surprise come April when you learn that you owe 10000 or more in taxes than you. Restricted stock units RSUs are company shares granted to employees.

RSU tax at vesting date is. An RSU taxation example. Lets calculate our the Alternative Minimum Tax we may owe.

BtwMy question has to do with selling share lots from an Employee Stock Purchase Plan at a loss. Restricted stock units RSU or RSUS are stock-based compensation primarily used to reward employees. On-hire stock awards these typically vest 25 per year over four years with one vest annually on your employment anniversary.

If youre looking for an RSU tax calculator for the UK I. 167k rsu 70k 4yrs to vet and bonus 15. The most significant implication for employees is a 25000 benefit.

The Bottom Line Stock options are when a company gives an employee the ability to purchase stock at a predetermined price at a given time. The alternative minimum tax which is a parallel tax system separate from regular tax laws can be complicated so getting a financial advisors help may be a good idea. Calculation on GainLoss on Sale of ESOP or RSU.

If held beyond the vesting date the RSU tax when shares are sold is. A restricted stock unit RSU on the other hand is compensation offered to an employee as company stock and received later when the vesting is complete unlike RSAs given on the grant date. How your stock grant is delivered to you and whether or not it is vested are the key factors.

Declaration of foreign assets for Indian residents Schedules FA FSI and TR in the Income Tax Return Includes Filing returns for foreign investments SOPs Shares etc. ESOP or Employee Stock Option Plan allows an employee to own equity shares of the employer company over a certain period of time. Everything under a certain amount is taxed at one percentage and everything over is at the other.

Net Salary Formula Calculation. The TurboTax community is a source for answers to all your questions about tax credits deductions and related financial topics. Generally your on-hire stock award shares will not vest until one year after employment starts.

Qualified ESPPs known as Qualified Section 423 Plans to match the tax code have to follow IRS rules to receive favored treatment. Friedmans article on this topic. Includes International sales transactions foreign investments.

So Amazon is going to automatically withhold 22 of those shares for taxes. Explaining Restricted Stock Units or RSU. There are only 2 tax rates.

While there is no value to the employee when the RSU are. It can be equal to the gross salary when the income tax is negligible and the salary of the employee falls below the government tax slab. It is a promise from your employer to give you shares in the company in the future.

RSUs are a popular form of compensation at large technology companies including Microsoft Amazon Intel and Google. Income Head Capital gain covers gain or loss from the selling of Equity Shares except intraday transactions Mutual Funds MF Restricted Stock Units RSU Equity Traded Funds ETFs and Employee Stock Option Plans ESOPs. I expect salary to be 225-300k and RSU to be over 100k I have over 10.

Check e-file status refund. The AMT tax bracket functions just like the regular income tax brackets in that it is marginal tax but much simpler. Restricted stock units RSUs are a form of equity compensation for employees.

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Strategies For 2022

Please Login Mystockoptions Com

Rsu Taxes Explained 4 Tax Strategies For 2022

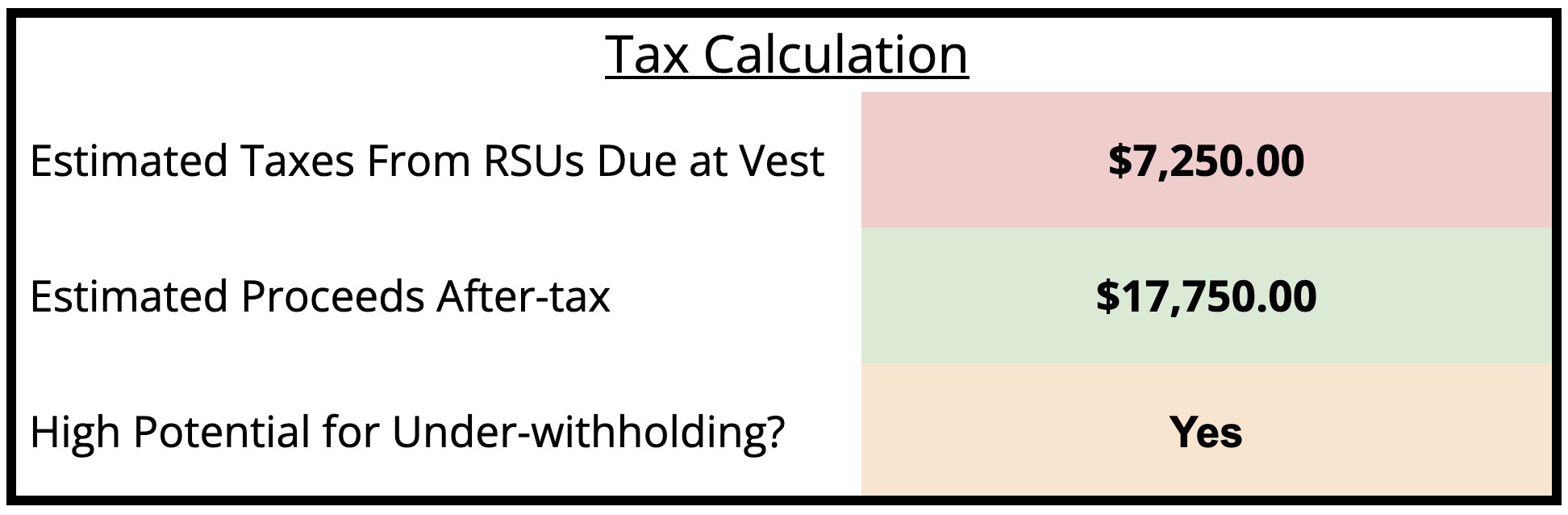

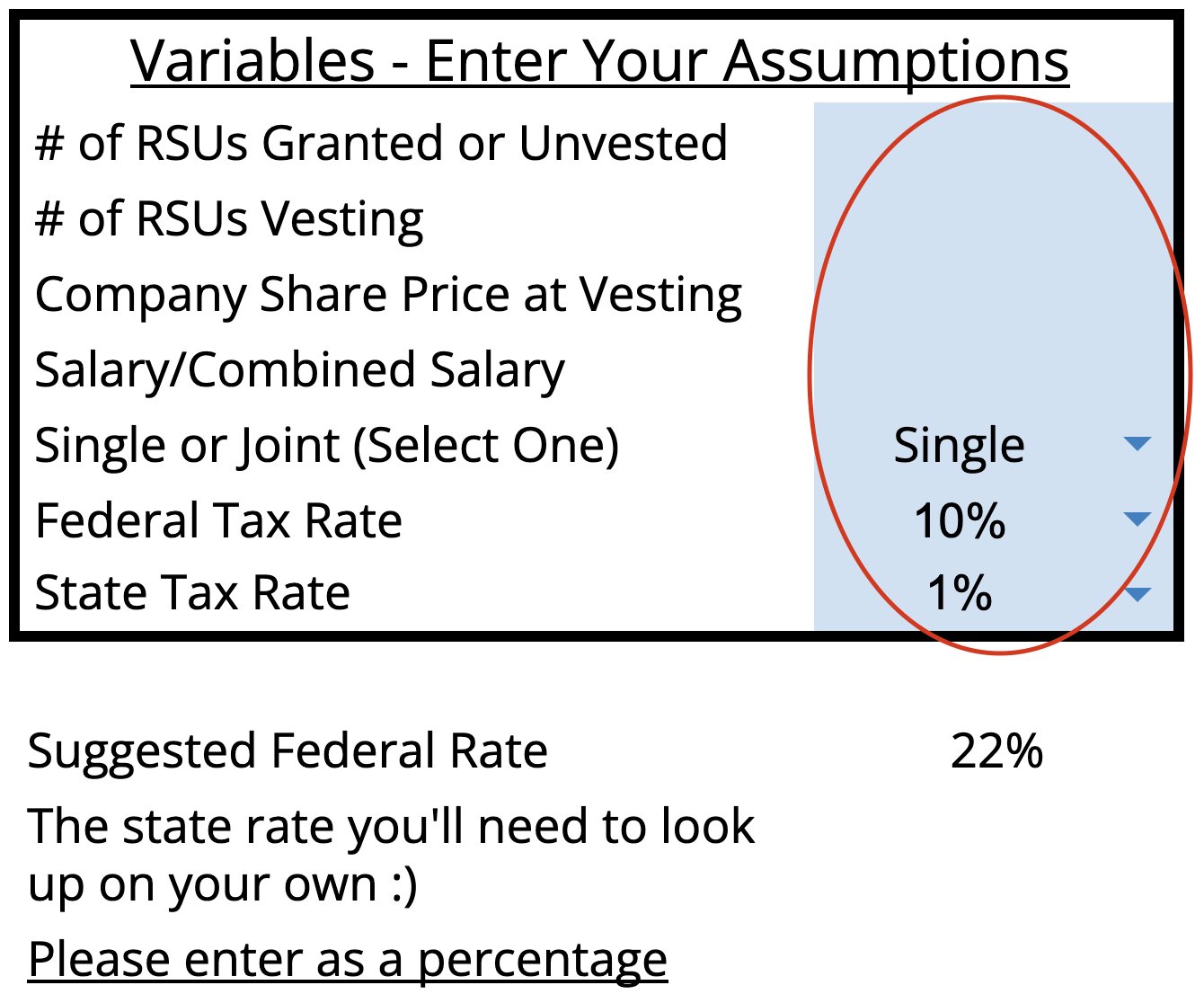

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

When Do I Owe Taxes On Rsus Equity Ftw

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Blog Upstart Wealth

Rsu And Taxes Restricted Stock Tax Implications

The Mystockoptions Blog Pre Ipo Companies

Rsu Taxes Explained 4 Tax Strategies For 2022